To address the poor savings culture in South Africa, long-term insurer, Liberty unveils its unique solution to remove the complexity and fear associated with investing.

Stash is an investment app designed to break through all the complicated investment jargon, processes, tedious forms, cashing out difficulties and reduces the amount of time it takes to meet with a financial adviser.

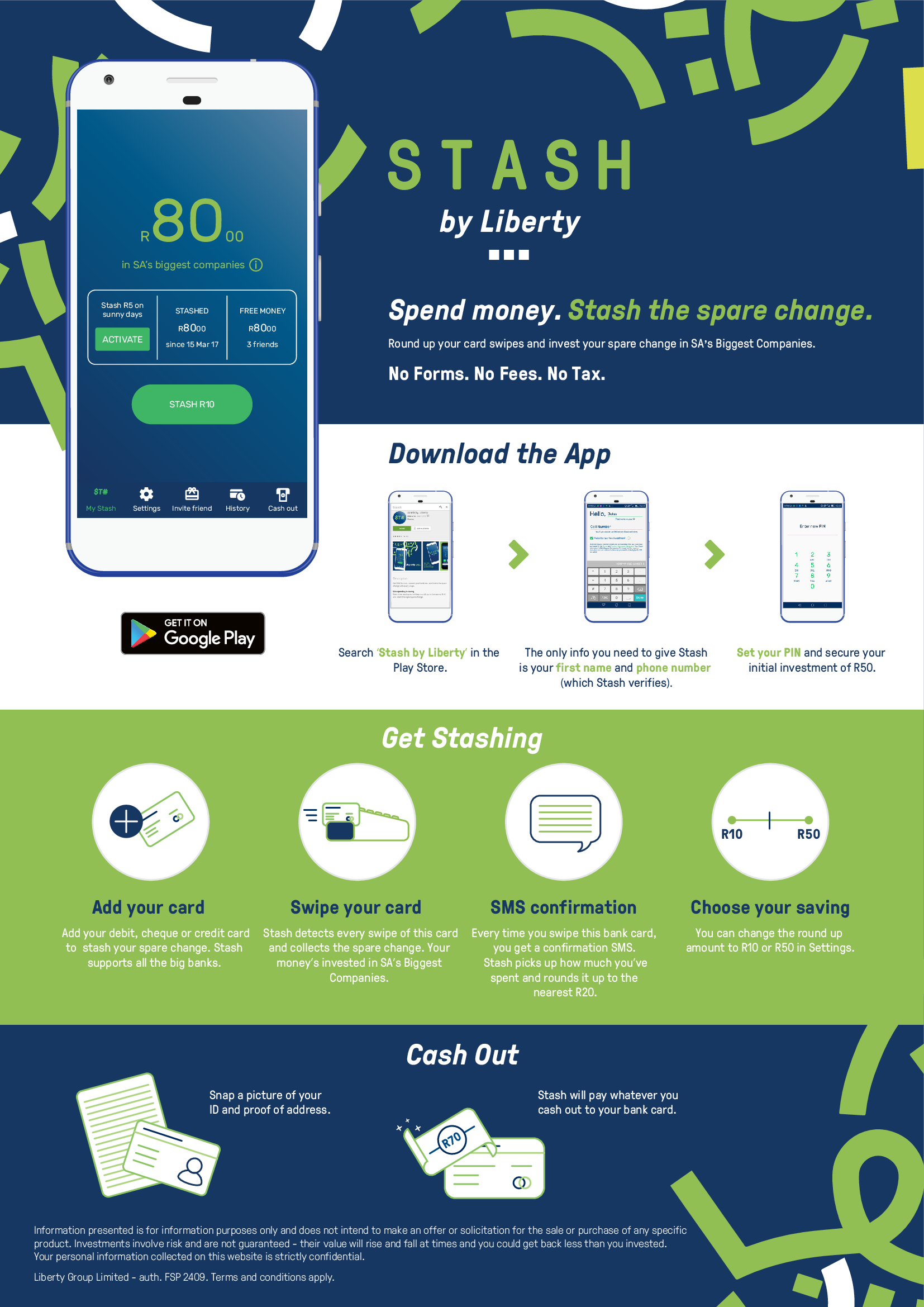

Downloading Stash is quick, convenient and simple. The average user takes 49 seconds to set up their Stash – from start to finish. When you download Stash from your Play Store, you get R50 upfront just for signing up and to kick start your investment journey. Every time you refer a friend, you are rewarded with R10 added to your Stash account.

Juan Labuschagne, head of development at Stash says, “When it comes to investing, getting started is the hardest part. I can remember the homework I had to do to make sense of where I was putting my money. It seemed like too much work and I kept putting it off. Investing should be as easy as tweeting – that’s the goal of Stash.”

Users decide how much they want to stash. The app rounds up the amount of every transaction. If a user decides that their Stash limit per transaction is R10 and they make a transaction for R45, this would be rounded up to R50. The R5 in change is stashed.

Labuschagne explains, “All this spare change accumulates without interfering with your day-to- day life. Stash checks your daily bank balance and never transfers more than you can afford, so you don’t have to worry about going into overdraft. Before you know it you’ll have a significant Stash balance. Your Stash grows as fast as South Africa’s biggest companies do because your spare change is invested in South Africa’s top 100 listed companies.”

An additional benefit of Stash is that you don’t pay any tax on the cash that is stashed. You can invest up to R33,000 a year, up to R500,000 over your lifetime, into your tax-free investment. These limits go across ALL your tax free savings accounts you may have. You are not taxed on the growth of your money, not penalised when you cash out and can put in or withdraw money whenever you like.

Stash is currently available for Android powered mobile phones. “In South Africa, 9 out of 10 smartphones are Android devices. Our goal is to get Stash in the hands of as many people as possible, so focusing on 90% of the market was ideal,” concludes Labuschagne.

Stash is an investment first, truly created for the ordinary man in the street, taking less than a minute to set up. It is the first app in South Africa that gives novice investors access to the power of the stock market with zero fees. Investors can access their money whenever they need it.